Car title loans cater to contractors' unique financial needs, offering immediate funding using vehicle titles as collateral. Accessible to those with limited credit history, this method provides simpler eligibility criteria and flexible repayment terms. Contractors can bridge income gaps during unpredictable periods, managing cash flow effectively without penalties. Despite challenges of variable income and temporary vehicle transfer, responsible lending practices ensure a reliable financial option for self-employed construction workers.

In the dynamic world of construction, where work schedules are often unpredictable, contractors face unique financial challenges. This article explores a solution: car title loans tailored for their needs. We delve into “Car Title Loans for Contractors with Irregular Work Schedules,” understanding their complexities and navigating the options available. By examining benefits and challenges, we empower contractors to make informed decisions about this alternative financing method.

- Understanding Car Title Loans for Contractors

- Navigating Irregular Schedules: Loan Options Explored

- Benefits and Challenges: A Comprehensive Look

Understanding Car Title Loans for Contractors

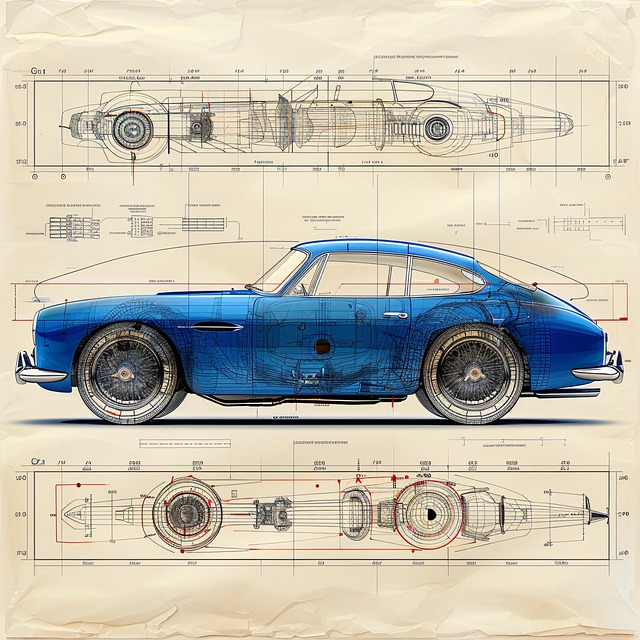

Car title loans for contractors with irregular work schedules offer a unique solution to their financial needs. These loans are designed specifically to cater to the unpredictable nature of construction work, where income can fluctuate significantly. By using your vehicle’s title as collateral, contractors can access a lump-sum amount to cover immediate expenses or bridge the gap between jobs. This alternative financing method is particularly appealing for those with limited credit history or poor credit scores, often a challenge for self-employed individuals in the construction industry.

Unlike traditional loans that require strict eligibility criteria and extensive documentation, car title loans provide a more straightforward process. Lenders assess the value of your vehicle and its title to determine the loan amount, and as long as you own the car outright with no outstanding liens, you could qualify for a direct deposit into your bank account. This accessibility ensures contractors can secure funding promptly, making it easier to manage cash flow during periods of irregular work schedules or unexpected delays on job sites. Additionally, with clear terms and conditions, these loans often include options for loan payoff flexibility, allowing contractors to pay off the debt at their own pace without penalties.

Navigating Irregular Schedules: Loan Options Explored

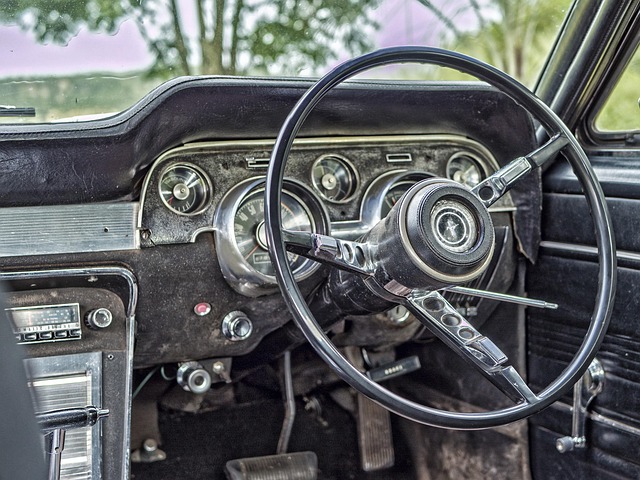

For contractors with irregular work schedules, accessing traditional loan options can be a challenge. They often face rejection from banks due to inconsistent income and lack of stable employment. This is where car title loans step in as a viable alternative for these professionals. A car title loan for contractors allows them to leverage their vehicle’s equity, providing quick access to cash without the strict requirements of conventional loans.

Navigating irregular schedules doesn’t have to mean being locked out of financial opportunities. By exploring car title loan options, contractors can take control of their finances despite unpredictable work patterns. Unlike traditional loans with stringent payoff plans and potentially high-interest rates, car title loans offer flexible repayment terms tailored to freelancers’ needs. This ensures contractors can manage their cash flow effectively while meeting loan requirements, keeping them afloat during slow periods and enabling them to capitalize on lucrative job opportunities when they arise.

Benefits and Challenges: A Comprehensive Look

The car title loan for contractors with irregular work schedules presents both benefits and challenges unique to their line of work. One significant advantage is quick funding. Given the unpredictable nature of construction projects, contractors often require access to capital swiftly to seize opportunities, cover unexpected expenses, or manage cash flow during slow seasons. Car title loans, known for their straightforward application process and faster turnaround times compared to traditional loans, cater to these needs effectively.

On the other hand, loan terms and title transfer procedures can be considered challenges. Irregular work schedules might lead to inconsistent income, making it challenging to meet loan repayments on time. Additionally, the title transfer process involves temporarily handing over vehicle ownership to the lender until the loan is repaid, which could be a concern for contractors relying on their vehicles as essential tools for their trade. However, responsible lending practices and clear communication between lenders and borrowers can help mitigate these challenges, ensuring contractors have a reliable financial solution during periods of fluctuating work availability.

Car title loans for contractors with irregular work schedules offer a unique solution to their financial needs, leveraging their vehicle’s equity. By understanding the various loan options available and weighing the benefits and challenges, contractors can make informed decisions that best suit their unpredictable yet rewarding careers. This alternative financing method provides quick access to capital without the stringent requirements of traditional loans, making it an attractive option for those in this dynamic industry.